We have identified operational, regulatory, and other potential risks and opportunities related to climate change, which are disclosed in our annual TCFD report. These climate-related risks and opportunities could have financial impacts on our revenue, costs, asset values, and other aspects. For more details, please refer to our latest TCFD report.

Climate Change Management Framework

/

-

Governance

The highest governance level is the board of directors.- Review climate issues and other critical business matters. Senior management has established a TCFD committee.

- The committee is chaired by the general manager and composed of other senior executives.

- Responsibilities include gathering and assessing climate risk issues, identifying climate risks, formulating response strategies and goals, monitoring implementation progress, and reporting to the board of directors.

-

Strategy - The TCFD task force adopts a collaborative discussion approach.

- Incorporate transition risks and physical risks into scenario analysis to identify short-term, medium-term, and long-term climate risks and opportunities. Evaluate the impact of significant climate risks and opportunities on the company, including potential financial impacts.

- Transition risks: Policy and regulatory, technological, market, and reputational

- Physical risks: Immediate risks (e.g., typhoons, floods) and long-term risks (e.g., temperature changes, sea level rise)

- Opportunities include resource efficiency, new energy sources, products/services, market opportunities, and resilience.

- Upgrade high-performance production equipment, conduct greenhouse gas inventories, implement energy-saving measures, and align with corporate sustainability goals to achieve the vision of transitioning to a low-carbon economy.

-

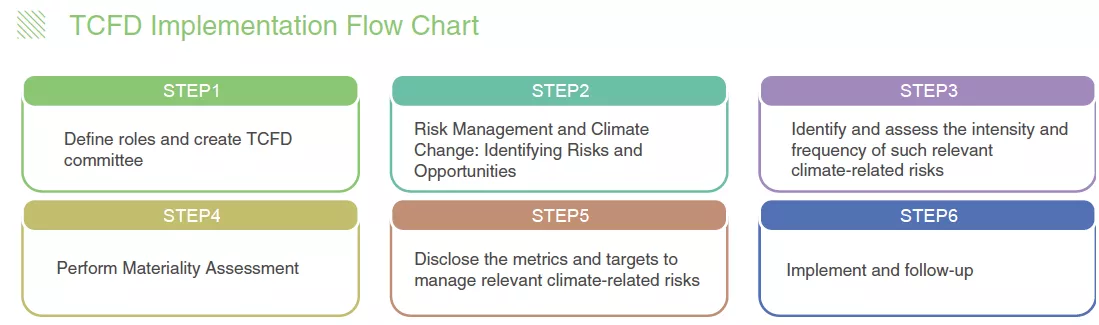

Risk Management - Develop a climate risk identification process based on the TCFD framework.

- Based on identified risk outcomes, formulate corresponding response strategies and integrate them into sustainability action plans, with goals for monitoring and review.

- Climate related issues are included ISO regulation of our company.

-

Metrics & Targets - Establish relevant management metrics and set goals for regular monitoring of implementation progress.

- Track the implement with low carbon transition and sustainability development to ensure the efficiency of these measures.

Identifying Risks & Opportunities

-

Step1 Identify and assess the intensity and frequency of climate-related risks.

We have identified a total of 10 categories of climate transition risks, 10 categories of physical risks, and 2 categories of climate opportunities, totaling 34 climate-related issues.

-

Step2 Risk and Impact analysis on Operation

We convene cross-departmental meetings to integrate perspectives from various units, comprehensively analyze potential risks, and assess the severity of threats. -

Step3 Significant Risks/ Opportunities Assessment

We have identified 3 significant transition risks in the short-term and 1 derivative climate opportunity. -

Step4 Metrics & Targets

We have developed corresponding action plans to address the identified significant climate risks and opportunities, and we are continually monitoring the progress of implementation to ensure effective management.